nh meals tax rate

If you have any questions about tax-exempt sales please call the Departments Division of Taxpayer Services for. Starting october 1 the tax rate for the meals and rooms.

A 9 tax is also assessed on motor vehicle rentals.

. Business Profits Tax. New Hampshire Department of Revenue. New Hampshires sales tax rates for commonly exempted categories are listed below.

Exact tax amount may vary for different items. Exemptions to the New Hampshire sales tax will vary by state. Starting October 1 2021 the New Hampshire Department of Revenue Administration NHDRA is decreasing the states Meals and Rooms Rentals Tax rate from.

Some schools and students. Meals paid for with food stampscoupons. In addition New Hampshires apportionment factor will change from the current three factors payroll sales and property to a single sales factor.

New hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85. Since January 1991 OSI formerly the Office of.

Concord NH The. Meals and Rooms Tax Data. New hampshire meals and rooms tax rate drops beginning friday.

Concord NH The New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals. New Hampshire is one of the few states with no statewide sales tax. The current tax on nh rooms and meals is currently 9.

Some rates might be different in Exeter. Granite Staters grabbing a bite to eat or staying in a hotel beginning Friday will see a little bit of relief moving forward. A 9 tax is also assessed on motor.

The New Hampshire sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the NH state tax. New Hampshire Department of Revenue Administration NHDRA is. Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85.

A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. If you need any assistance please contact us at 1-800-870-0285. The state meals and rooms tax is dropping from 9 to 85.

Annual Meals Rooms Tax Distribution Report Revenue to Cities and Towns MR Tax Homepage MR Tax Frequently Asked Questions. New Hampshires meals and rooms tax decreases 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. New Hampshire Sales Tax Rate.

A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

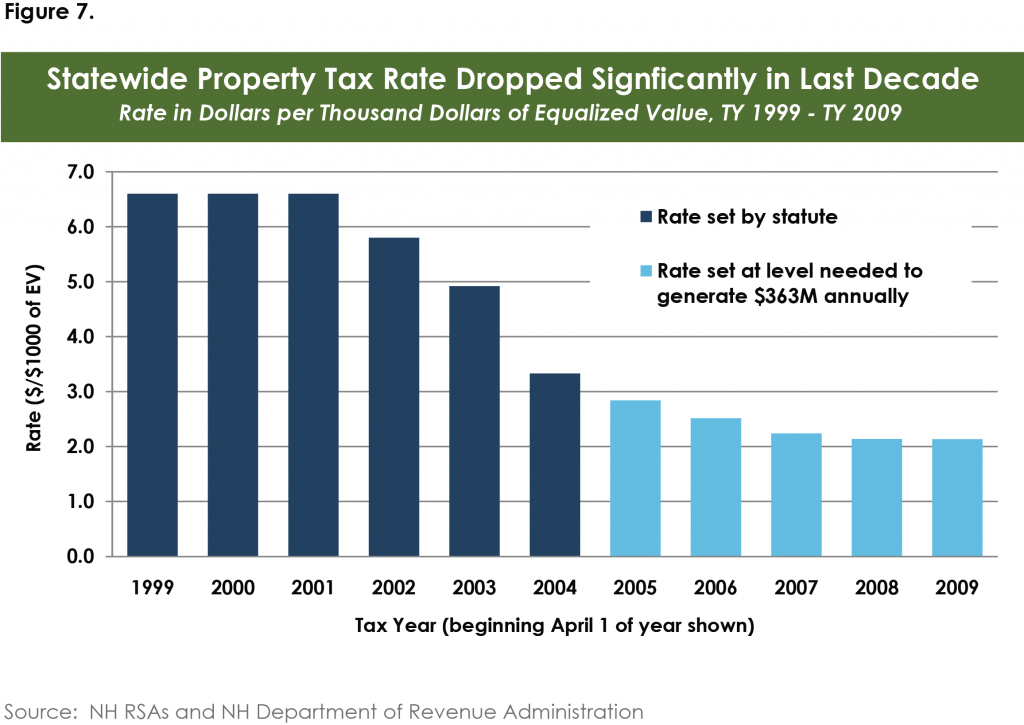

Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Property Tax Rates - and other information from the Department of Revenue Administration.

LicenseSuite is the fastest and easiest way to get your New Hampshire meals tax restaurant tax.

Valley News Sununu S Pitch To Suspend Rooms And Meals Tax Worries Nh Town Officials

Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin

Sununu S Pitch To Suspend Rooms And Meals Tax Worries Town Officials Nh Business Review

Why New Hampshire Attracts More Wealth And Commerce Than Maine Maine Policy Institute

Portsmouth Sets City Property Tax Rate At 15 03 Per 1000 Of Assessed Value

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Business Nh Magazine State Revenue Surplus Tops 400 Million

States With The Highest Lowest Tax Rates

Food Pantry Town Of Nottingham Nh

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Business Nh Magazine Nh Taxes Are Complicated And Grow More So

States Without Sales Tax Article

New Hampshire Food Assistance Helping Americans Find Help

N H Business Taxes Slide In February But Total Revenues Up Indepthnh Orgindepthnh Org

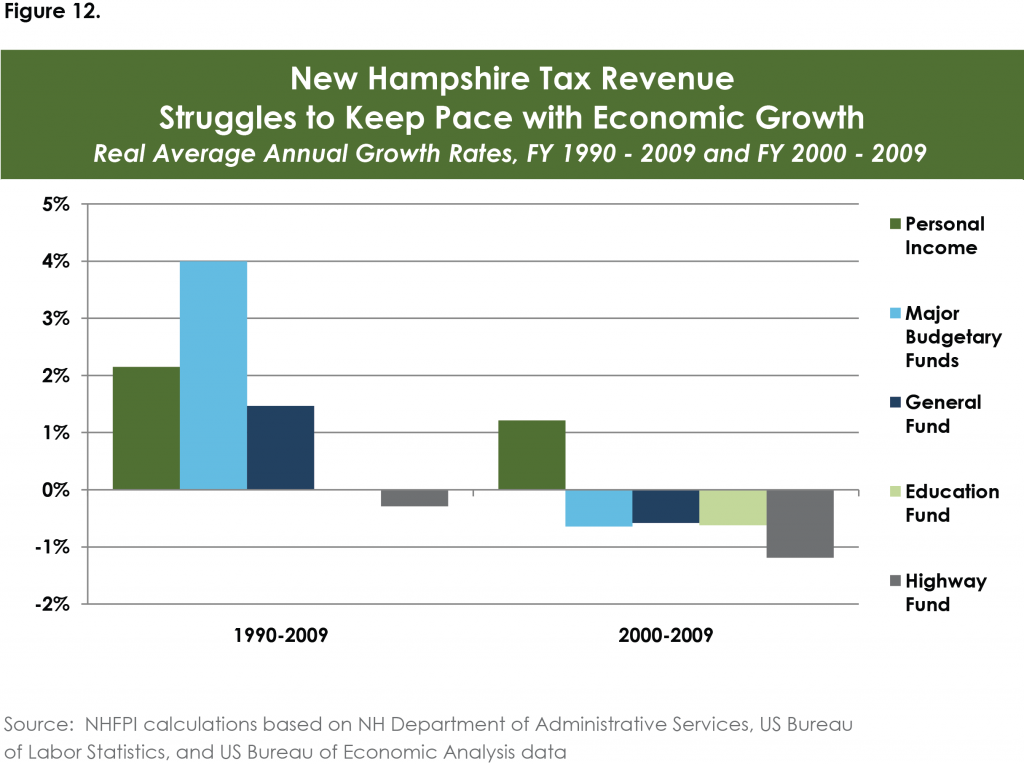

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Sales Taxes In The United States Wikiwand

New Hampshire Tax Rates Rankings Nh State Taxes Tax Foundation